North Dakota State Treasury Unclaimed Money

Home The Office of North Dakota State Treasurer

January 27, 2026 $4,400,934,570.06 * Balance reflects previous business day The State of North Dakota has numerous special funds. Click here for more details such as revenue source of the funds, the use of the funds, and the fund balance information based on availability.

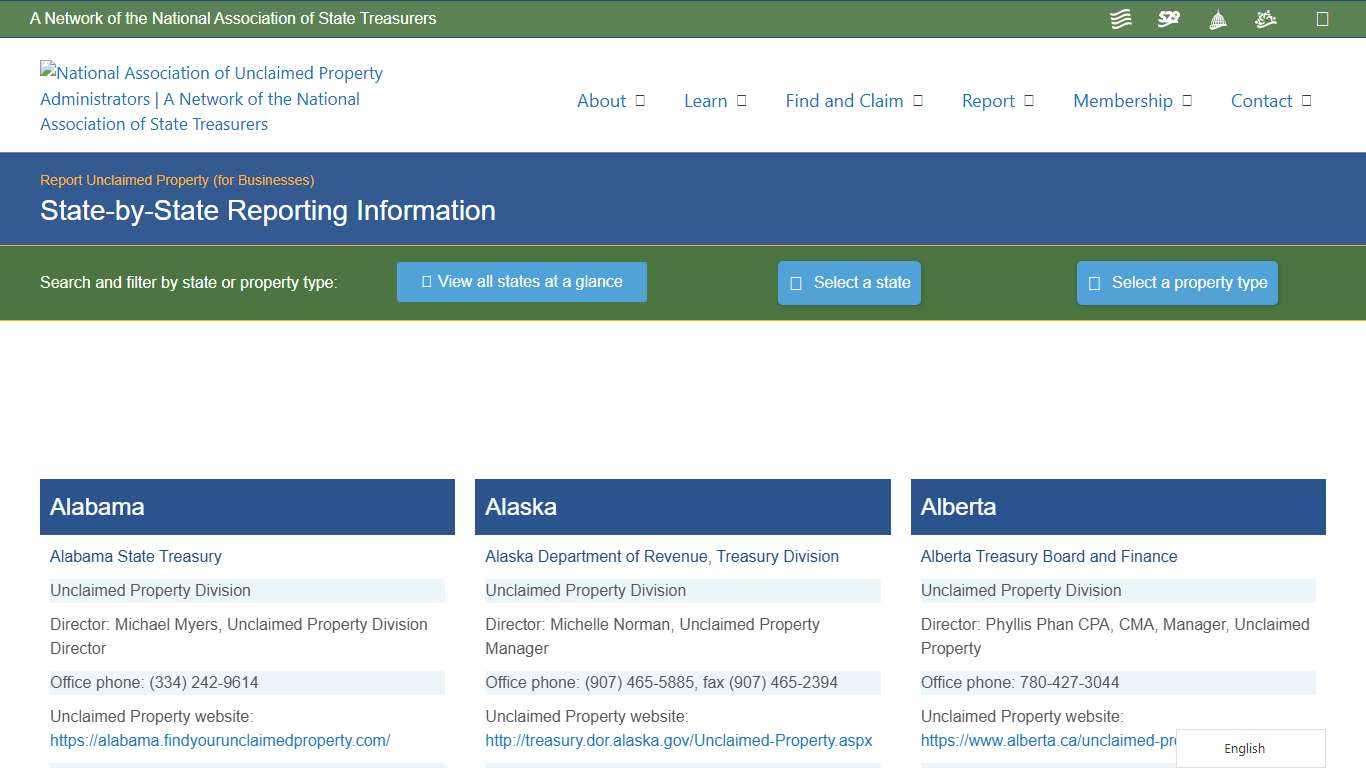

https://www.treasurer.nd.gov/homeNorth Dakota – National Association of Unclaimed Property Administrators (NAUPA)

Dormancy Periods The following dormancy periods are listed in years, unless otherwise noted. Reporting and Payment Due Dates The following indicates the report and payment due dates for the various property types. Electronic Reporting Capability Schedule The following indicates which types of reporting formats are accepted by this state.

https://unclaimed.org/reporting/north-dakota/

North Dakota Township Officers Association - Unclaimed Funds

List of Townships that have unclaimed funds...

https://www.ndtoa.com/about-townships/unclaimed-funds/

Home Trust Lands

WELCOME TO THE NORTH DAKOTA DEPARTMENT OF TRUST LANDS THANK YOU FOR YOUR CONTINUED SUPPORT IN FUNDING K-12 EDUCATION IN NORTH DAKOTA Thursday, January 29, 2026 at 09:00 am - 11:00 am Categories: Land BoardThe Board of University & School Lands will meet for its next regular meeting on Thursday, January 29th at 9:00 AM in the Governor's conference room and online with Microsoft Teams.

https://www.land.nd.gov/homeState treasurer says unclaimed property windfalls are likely to continue SDPB

Larger amounts of unclaimed property dollars in South Dakota are expected to continue for a few years. That’s what one of the state’s chief financial officers said he’s hearing. Unclaimed property is an asset that hasn’t had activity on it and is considered abandoned.

https://www.sdpb.org/business-economics/2026-01-15/state-treasurer-says-unclaimed-property-windfalls-are-likely-continue

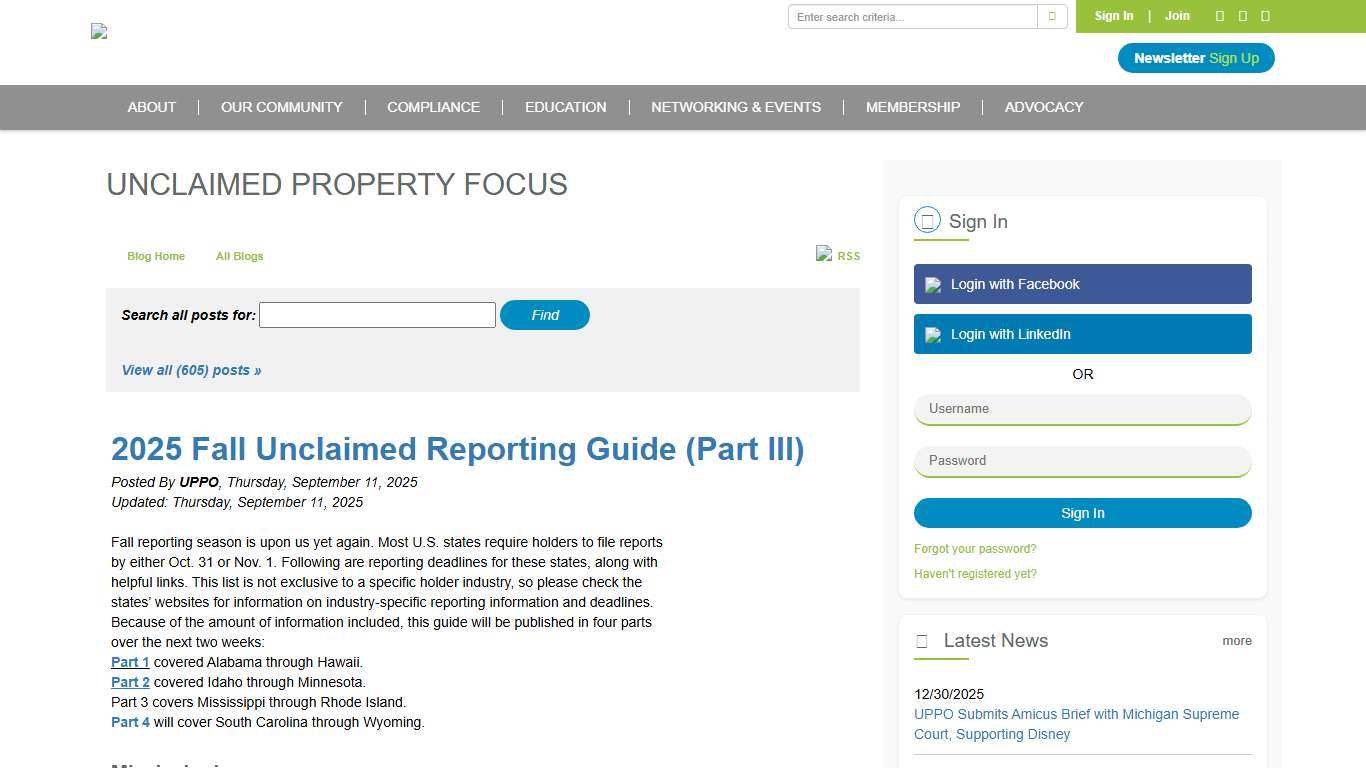

2025 Fall Unclaimed Reporting Guide (Part III) - Unclaimed Property Professionals Organization

Fall reporting season is upon us yet again. Most U.S. states require holders to file reports by either Oct. 31 or Nov. 1. Following are reporting deadlines for these states, along with helpful links. This list is not exclusive to a specific holder industry, so please check the states’ websites for information on industry-specific reporting information and deadlines.

https://www.uppo.org/blogpost/925381/513729/2025-Fall-Unclaimed-Reporting-Guide-Part-III

North Dakota Escheatment Guide Eisen

North Dakota Managing unclaimed property in North Dakota is more than following a checklist—it’s about protecting your customers and safeguarding your reputation. At Eisen, we simplify the escheatment process, helping businesses stay ahead of deadlines while minimizing risk and administrative overhead.

https://www.witheisen.com/state-guides/north-dakota

State-by-State Reporting Information – National Association of Unclaimed Property Administrators (NAUPA)

Copyright 2026 · National Association of Unclaimed Property Administrators, a Network of the National Association of State Treasurers. English. Español ...

https://unclaimed.org/state-reporting/

Bismarck Community Buzz https://unclaimedproperty.nd.gov/ Facebook

It is legitimate. Companies are required to turn it over to the state for custody if they cannot find the owner after x number of years (varies depending on what it is). If you go to www.MissingMoney.com you can search every state at once.

https://www.facebook.com/groups/1222541665646776/posts/1548716763029263/

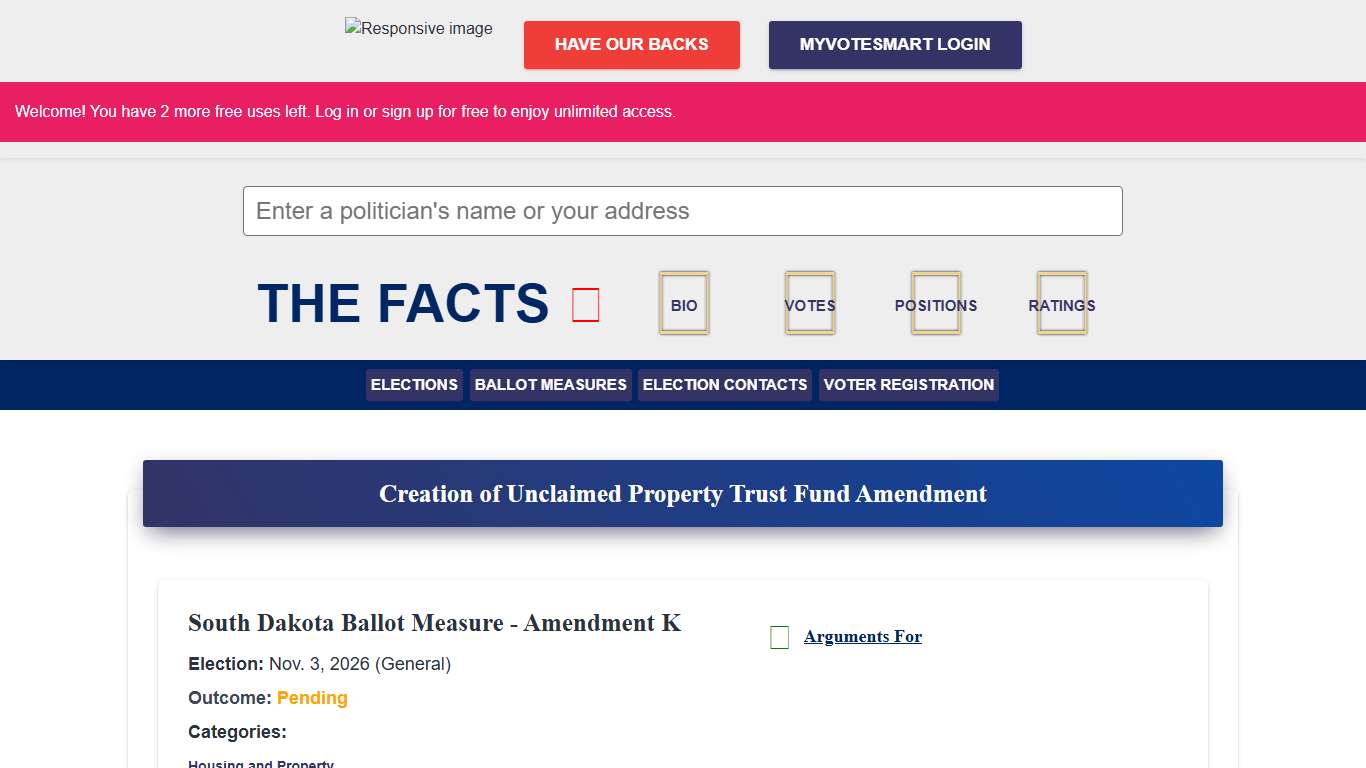

Vote Smart - Facts For All

This amendment would create a trust fund for unclaimed property, requiring the state treasurer to deposit any unclaimed property funds into the trust fund after covering claims, expenses authorized by law, and designated deposits to the general fund. Under the amendment, starting in July 2027 and then every year thereafter, the state treasurer would distribute a portion of the interest and income of the trust fund into the state general...

https://justfacts.votesmart.org/elections/ballot-measure/3092/creation-of-unclaimed-property-trust-fund-amendment

Lawmakers aim to stabilize ‘volatile’ unclaimed property revenue with trust fund • South Dakota Searchlight

13:53 News Story South Dakota lawmakers, the Governor’s Office and the state Treasurer’s Office hope to bring more predictability to a volatile revenue source and protect the state from a large liability by creating a trust fund for unclaimed property. Senate Bill 155, advanced by the Senate Appropriations Committee on Tuesday at the Capitol in Pierre, would limit the amount of unclaimed property funds that could be used in the...

https://southdakotasearchlight.com/2025/02/18/lawmakers-stabilize-volatile-unclaimed-property-revenue-trust-fund/

News Trust Lands

News Friday, January 16, 2026 at 08:00 am Please note that this list of available tracts will be updated as tracts are leased and no longer available. Tracts are available until January 31st. After that date the unleased tracts will be removed from our website to be offered again at public auction in the Spring.

https://www.land.nd.gov/news

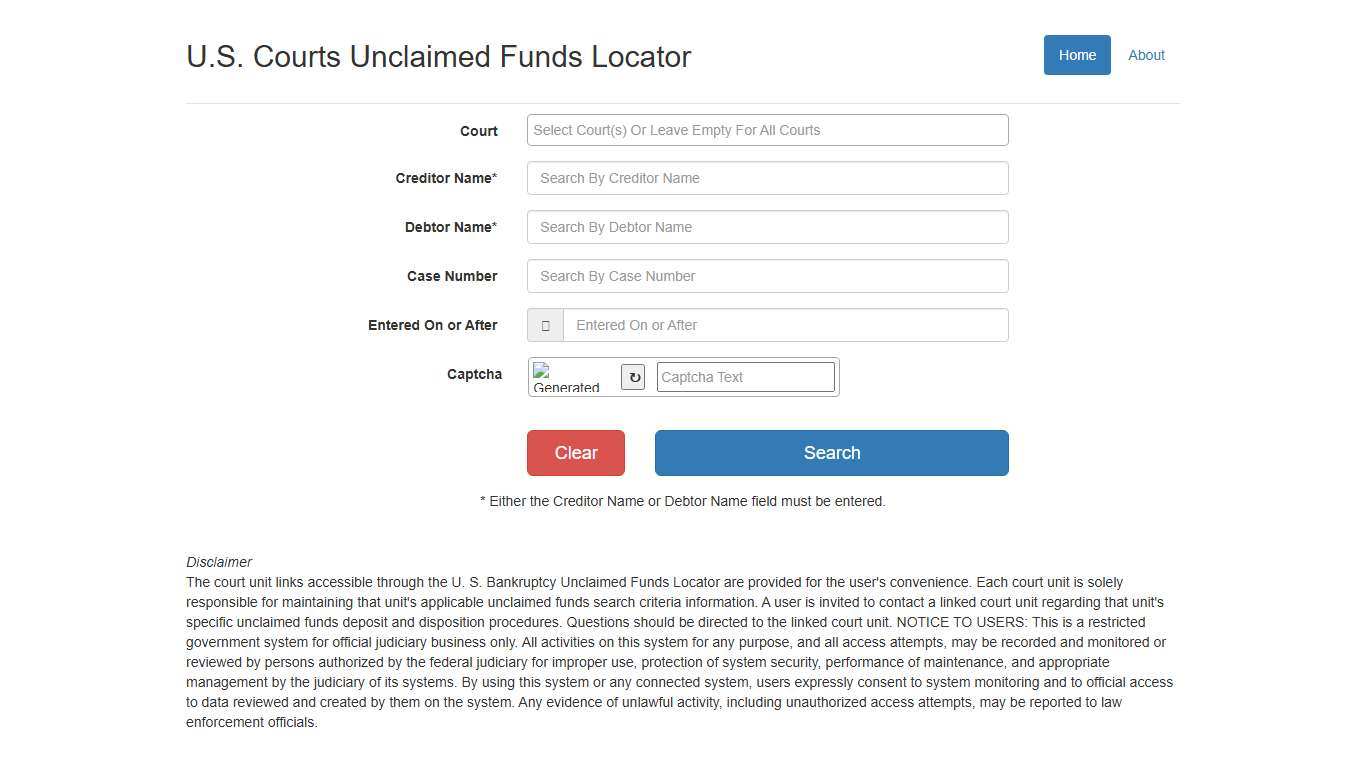

Unclaimed Funds Locator

* Either the Creditor Name or Debtor Name field must be entered.

https://ucf.uscourts.gov/

National Association of Unclaimed Property Administrators (NAUPA) – The leading, trusted authority in unclaimed property

NAUPA is the leading, trusted authority in unclaimed property. We help individuals claim their unclaimed property, and help businesses ensure compliance per state law in annual reporting. Search for property in your state or province Use the interactive map below or select from the list to find the official unclaimed property program for a state or province.

https://unclaimed.org/

Codified Law 43-41B-24.5 South Dakota Legislature

43-41B-24.5. Net receipts reduction--Distribution amount. Beginning in fiscal year 2026 and each fiscal year thereafter, the state treasurer shall, after paying from the unclaimed property operating fund all claims and any administrative costs associated with the sale of unclaimed property, deposit into the general fund the net receipts from unclaimed property, up to the general fund contribution limit, as established in § 43-41B-24.3.

https://sdlegislature.gov/Statutes/43-41B-24.5

Savings Bonds: About — TreasuryDirect

When you buy a U.S. savings bond, you lend money to the U.S. government. In turn, the government agrees to pay that much money back later - plus additional money (interest). When you buy a U.S. savings bond, you lend money to the U.S.

https://treasurydirect.gov/savings-bonds/